USDJPY - Is this the end of negative rates?

USDJPY Analysis - End of the Negative Interest Rate Policy?

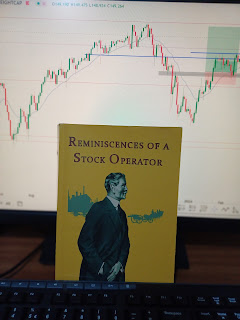

USDJPY Daily Chart

A glance at the daily chart shows the order flow has turned bearish. Driving this rally are the recent hawkish statements by the Bank of Japan members. Traders are interpreting this as a sign that the BOJ plans to exit the negative interest rate policy.

The governor's comments on inflation were more positive than in previous meetings, signalling a path to policy normalisation. The central bank is considering whether to retain the negative rates, a clear hawkish sign that saw bulls rush for the exits.

I did have an open trade and was hoping the price would touch the 152 level before we saw a major sell-off. I have since exited the JPY position. I am a technical trader but I do read fundamentals just to be aware of what is driving price action for the long term. Central bank announcements are a key source of fundamentals since they are tasked with maintaining price stability. Inflation data is one of the bank's key decision drivers, this in turn affects interest rates, which affect capital flows as investors will always seek higher rates (carry trades).

Recent comments by Jerome Powell of the US Reserve Bank, also fuelled the rally after he suggested they will probably be cutting interest rates sometime this year.

In my opinion, the interest rate differential between the two currencies is still high and I favour the dollar to strengthen against the Yen long term. But always remember, price is the final arbiter of truth. The charts will tell us what to do. I usually don't look to trade tops or bottoms, I prefer the middle of the move after the price gives me enough confidence in its intended direction. For now, let's keep an eye out for price action around the 147 and 146 regions to give a hint of what the USDJPY is likely to do next.

_webp_40cd750bba9870f18aada2478b24840a.webp)

Comments

Post a Comment