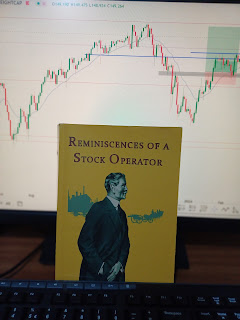

Lessons from a trading great - Jesse Livermore #1

If you go online scouting for the best trading books, Reminiscences of a stock operator by Edwin Lefevre will always pop up among your searches. I consider it to be among the best trading books ever written. I have personally read it a couple of times and in today's blog I will be sharing the timeless lessons I got from the book. This is the first of several series I will be doing about this great book, I hope the lessons resonate with your trading journey and that they are helpful:

- A battle goes on in the stock market and the tape is your telescope. You can depend on it seven out of ten times.

- Whatever happens in the market today has happened before and will happen again.

- Only play the markets when you are satisfied that precedents favored your play.

- There is a plain fool, who does the wrong thing at all times everywhere, but there is the wall street fool, who thinks he must trade all the time. No man can have adequate reasons for buying or selling stocks daily. The desire for constant action irrespective of underlying conditions is responsible for may losses in wall street even among the professionals, who feel they must take home some money every day as though they working for regular wages.

- Don't believe in tips. A man must believe in himself and his judgement if he expects to make a living at this game. Nobody can make big money on what someone else tells him to do.

- Speculation is a hard and trying business, and a speculator must be on the job all the time or he'll soon have no job to be on.

- When a man is right, he want to get all that is coming to him for being right. Always aim for the jugular when conditions favor your play. What is the use of being right unless you get all the good possible out of it.

- If a market doesn't act right, don't touch it; because being unable to tell precisely what is wrong, you cannot tell which way it is going. No diagnosis, no prognosis.

- There is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order to lose money, you begin to learn what to do in order to win.

- They say you never grow poor taking profits. No you don't. But neither do you grow rich taking a four point profit in a bull market.

- Big money is not in the individual fluctuations but in the main movements - that is, not in reading the tape but in sizing up the entire market and its trend. Disregarding the big swing and trying to jump in and out of the market can be fatal. Nobody can catch all the flactuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this always be aware of the general conditions.

- " I was never in my thinking that made the big money for me. It was always my sitting"

- It is the big swing that makes the big money for you.

- Learn from your mistakes. Every time you find a reason for a loss or the why and how of another mistake, add a brand new Don't! to your schedule of assets. It is profitable to study your mistakes.

- Price like everything else move along the line of least resistance. They will do whatever comes easiest, therefore they will go up if there is less resistance to an advance than to a decline and vice varsa.

_webp_40cd750bba9870f18aada2478b24840a.webp)

Comments

Post a Comment