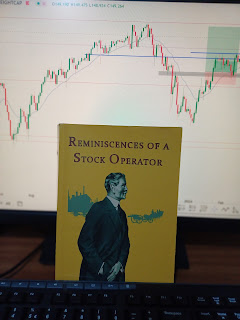

Welcome to part 2 of Lessons from a trading great - Jesse Livermore. This is a continuation of lessons I picked from reading the book Reminiscences of a stock operator by Edwin Lefevre : Lets dive in: The speculator is not an investor. His object is not to secure a steady return on his money at a good rate of interest, but to profit by either a rise or a fall in the price of whatever he may be speculating in. Therefore, the thing to determine is the speculative line of least resistance at the moment of trading; and what he should wait for is the moment when that line defines itself, because that is his signal to get busy. Stocks are never too high to buy or too low to sell. The price, per se has nothing to do with establishing the line of least resistance. In trading, a man has to guard against many things, and most of all against himself - that is, against human nature. It is not wise to disregard the message of the tape, no matter what your opinion of the fundamentals is....

_webp_40cd750bba9870f18aada2478b24840a.webp)

Comments

Post a Comment