Patient traders are profitable traders

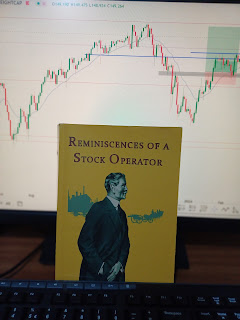

Image by Tumisu from Pixabay Posting this email excerpt from the Traders Mastermind. Patience is the one thing that stops most traders from becoming the traders they want to be. It’s simple. Patient traders are profitable traders. Don’t believe me? Maybe these quotes from some of the best traders in the world will change your mind… “Trading is a waiting game. You wait and wait and wait. Then you get in. Then you wait and wait and wait some more.” - Jesse Livermore “Patience is essential for trading. When there is nothing to do, do nothing.” - Jesse Livermore “Successful investing is about managing risk, not avoiding it. Patience is one of the most important factors.” - Benjamin Graham “The big money is not in the buying and selling, but in the waiting.” - Charlie M...

_webp_40cd750bba9870f18aada2478b24840a.webp)